Every Month, Mr Forrest Barbee and Equity Title

put out a Monthly Market Update.

Below are the main points, and my comments.

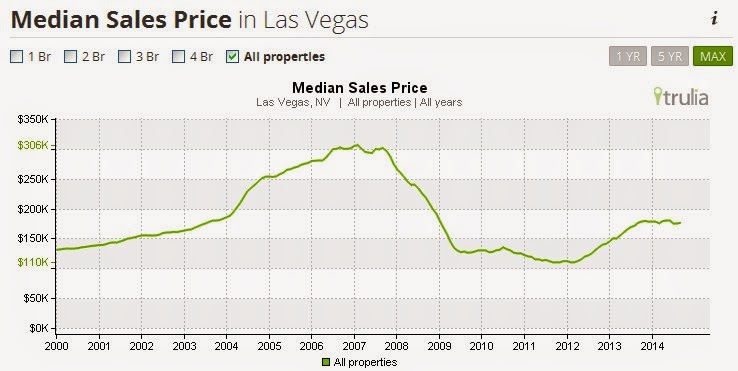

We have seen this Price Graph before.

Just to reiterate, these recent rises in price are a recovery, not a bubble.

Just 2 years ago, only 37% of all transactions were Traditional Sales (Classic)

As a Realtor, It's nice to work with People again, and not banks.

Again, only 2 years ago 53% of all transaction were CASH (usually investors)

This gives a good visual of how the Market has changed;

- Moving away from Foreclosure

- The rise and fall of Short Sales

and Traditional Sales returning us to a "Normal Market".

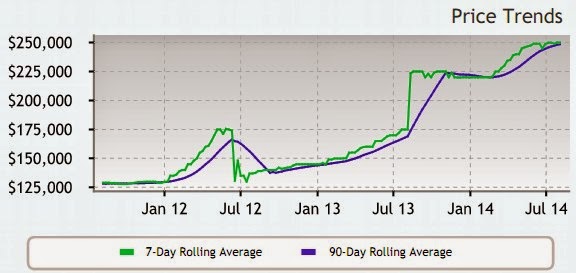

This might be the most thought provoking graph of them all.

Sales (solds) have stayed steady at around 3,000 a month.

When Inventory dropped, Prices started Rising.

When Prices rose, Home Owners once again had Equity.

Many people have been waiting a long time to have equity.

Now that they do, they can finally make the move they have been putting off.

We are now seeing a rise in the number of Listings.

Days on Market has been rising as well.

Now is the best time to Sell in the past 5+ years. ( for Sales Price)

But it needs to be priced right.

Still a great time to Buy.

Interest Rates are LOW.

And now Buyers have several houses to choose from.