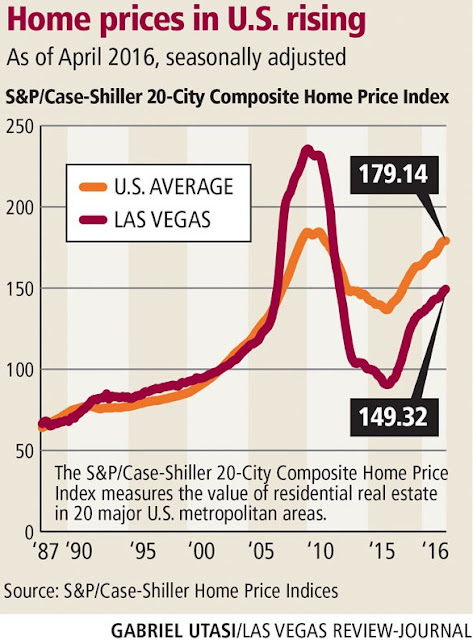

According to The Las Vegas Review Journal

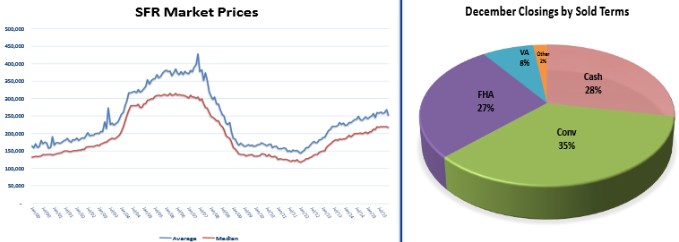

The Median Home Price for the Las Vegas Metropolitan Area is $240,000

Which is 7.9% higher than a year ago.

Below is a breakdown by City.

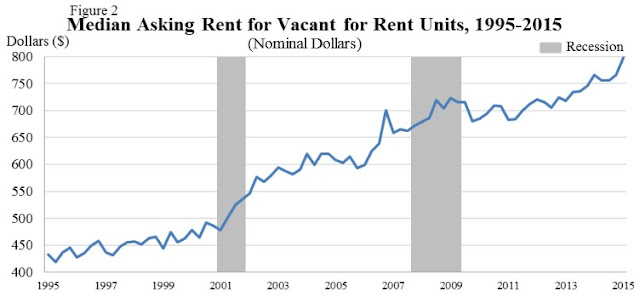

What stands out to me is the obvious Seasonal Trends.

A majority of the 7.9% annual growth happens between Feb - July

Anybody considering Buying soon should do it now.

Before the Seasonal Price Jump.